New Considerations for Investors and Regulators

Originally published on RMI Outlet, blog of the Rocky Mountain Institute

By Madeline Tyson

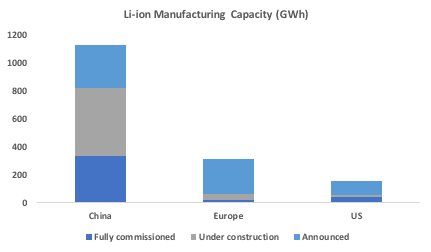

With the past few years’ enormous build out of lithium-ion (Li-ion) battery manufacturing plant capacity and near-term commitments to further expansions, battery storage costs continue to fall dramatically. Falling costs, coupled with improved performance, are enabling new battery applications that will dramatically accelerate the energy transition.

For many investors, policymakers, and system planners, the performance characteristics beyond price that garner the most attention are often metrics like energy density or safety. In the next five years, however, improvements targeting battery degradation (cycle life) may be more critical—not just for expanding EV adoption, but also for opening up new applications for batteries such as vehicle-to-grid services, second-life uses for batteries that are no longer suitable for mobility purposes, and long-duration storage. These applications could significantly shift the economics of batteries and open up new horizons of opportunity along previously untapped value chains—in other words, they would be game changers in terms of accelerating the transition to a clean energy system.

Not All Li-ion Batteries Are Created Equal

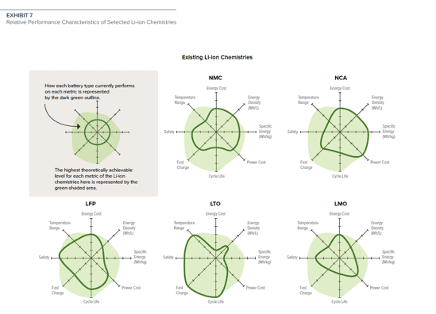

What many don’t realize is that Li-ion batteries include a wide diversity of electrochemical energy storage devices. As explained in RMI’s Breakthrough Batteries report, there are many types of Li-ion batteries, all with different performance characteristics and trade-offs. Countries, research entities, and manufacturers are investing substantially in research and development in pursuit of better and even cheaper, mostly Li-ion batteries.

Recently, a lot of buzz has surfaced about Tesla’s claim to have developed a Li-ion battery chemistry that can achieve a million miles over its lifetime, suggesting a dramatic improvement in degradation performance. While the most obvious implication is the ability to drive one million miles with the same battery (a feature useful for robot taxis), improvements in the lifetime of EV batteries have many other implications for expanding electrification use cases.

Li-ion batteries degrade due to several factors: time, number of cycles, depth of cycling, and temperature. Li-ion batteries that are optimized for energy density, such as NMC or NCA cathode chemistries, have historically had shorter cycle lives if they are routinely discharged completely (100 percent depth of discharge). The other most common Li-ion chemistry manufactured today is lithium iron phosphate (LFP), which is much heavier and less energy dense (not as good for light-duty vehicles) but with longer cycle life.

New Opportunities from Longer Cycle Life

Significant improvements in the cycle life of high-energy density Li-ion chemistries will be a huge step toward implementing EV fast charging, vehicle-to-grid capabilities, and longer duration storage installations, including leveraging second-life batteries. However, these improvements also pose challenges:

Fast charging

Fast charging is a crucial part of an electric mobility future, as it’s critical that EVs provide the same, if not better, functionality and ease of transport that exists today. Yet, deterioration rates for some types of Li-ion batteries are significant when they are quickly charged or discharged. Cathode and electrolyte improvements that lessen the severity of deterioration and extend battery life will decrease the negative impacts of fast charging.

Vehicle-to-grid (V2G) charging

The idea that vehicles can play a role in balancing the power grid is exciting, but it’s rife with challenges. Both Nissan and Fiat are engaged in pilots to test V2G models. Again, EV batteries decay with charge and discharge cycles. Battery warranty providers are uninterested in depreciating the mobility capabilities of those assets in exchange for a small reimbursement from the power grid.

Without improvements in EV battery cycling and longevity the pricing rate needed to incentivize vehicle-to-grid charging would most likely be far too high. Different and additional energy storage investments would likely be needed to provide this balancing capability. For example, pairing local energy storage with fast-charging infrastructure could still generate such benefits while also moderating the impacts of demand spikes from fast charging. The potential for EVs alone to provide distributed grid balancing or localized resilience is unlikely without significant EV battery performance improvements.

Longer-duration storage

The vast majority of grid-tied battery projects have targeted short-duration storage events, but as the cost of batteries has decreased, the average duration of such projects has increased from 1.5 hours in 2015 to 2.2 hours today. In addition to the fact that additional energy adds cost to projects, Li-ion storage project developers also typically overbuild the amount of energy they need by 10 to 30 percent. This additional capacity helps reduce the number of times batteries are completely discharged and can allow for some degradation.

Additionally, longer-duration installations often prioritize shorter-duration opportunities when possible, including ancillary services or short-term energy shifting (e.g., 15 minutes). Battery developers’ and asset owners’ preference for these shorter-term markets can undermine batteries’ resilience benefits for the grid. Batteries with better longevity and performance will not need to have as much buffer capacity or fear about battery degradation costs. As a result, longer-duration projects will be installed that will more often use their fully installed capacity in a way that significantly improves battery project economics. System planners, regulators, and investors should consider these attributes when designing and selecting systems.

Second-life batteries for long duration storage

Li-ion LFP already has a relatively long cycle life and is a logical choice for many grid installations. However, the ultimate price floor of LFP is expected to be around $60/kWh based on component material costs. This is likely too high for the type of long duration seasonal storage that will be needed for higher penetrations of renewable energy. This is especially true in colder parts of the world that face winter peak energy demands with limited resource availability, sometimes for long periods of time.

Form Energy has been tackling this problem with its innovative proprietary technology that targets a capital cost of less than $10/kWh. Recently the company signed an agreement to demonstrate a 150-hour duration storage project with Great River Energy, which is an important milestone and advancement for the energy transition.

Second-life Li-ion batteries could be another economic solution for long-duration storage, as their lower cost could meet the necessary threshold. This will require a buildout of the Li-ion ecosystem to include collection, testing, recycling and processing of batteries.

Current Li-ion batteries could be difficult to monetize for a large selection of second-life applications due to the variability in battery health and dramatic declines in cycling life and safety. To date, second-life Li-ion batteries have primarily been used for resilience applications on telecommunications towers, but some companies are testing second-life grid applications. As markets for longer duration storage mature, improved battery longevity will be necessary to provide confidence in the remaining energy content of repurposed EV batteries to match remaining value to use case. Additionally, Li-ion market consolidation toward fewer chemistries and shared standards between manufacturers would greatly help the second-life markets to track and work on this problem.

Looking Ahead

A forward-looking vision of the electricity grid includes fast charging, vehicle-to-grid capability, and long duration energy storage that includes second-life batteries. These emerging use cases will be significantly accelerated with an EV battery that has improved longevity. Investors, system planners, and policymakers should consider the impact of cycling on enabling future use cases when they look to incentivize and invest in storage solutions. This should include building out a robust battery supply chain that is increasingly standardized and can monitor and compare the remaining battery life in second-life batteries.